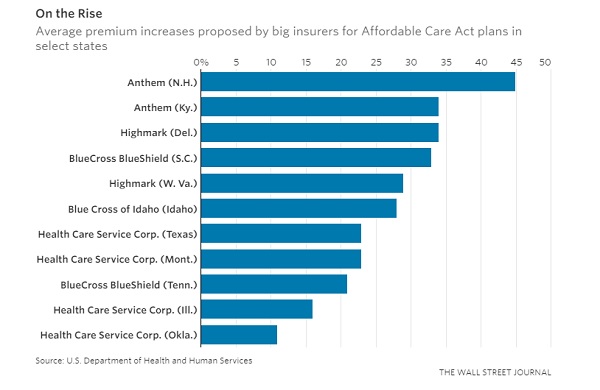

Major health insurers in some

states are seeking increases as high as 30% or more for premiums on 2018

Affordable Care Act plans, according to new federal data that provide the

broadest view so far of the turmoil across exchanges as companies try

to anticipate Trump administration policies.

Big insurers in Idaho, West

Virginia, South Carolina, Iowa and Wyoming are seeking to raise premiums by

averages close to 30% or more, according to preliminary rate requests published

Tuesday by the U.S. Department of Health and Human Services. Major

marketplace players in New Mexico, Tennessee, North Dakota and Hawaii indicated

they were looking for average increases of 20% or more.

In other cases, insurers are

looking for more limited premium increases for the suites of products they

offer in individual states, reflecting the variety of situations in different

markets. Health Care Service Corp., a huge exchange player in five states,

filed for average increases including 8.3% in Oklahoma, 23.6% in Texas, and 16%

in Illinois.

Together the filings show the

uncertainty in the health-insurance marketplaces as insurers around the U.S.

try to make decisions about rates and participation for next year amid open

questions about changes that could come from the Trump administration and

Congress.

Insurers face a mid-August

deadline for completing their rates. The companies have until late September to

sign federal agreements to offer plans in 2018. In some cases, insurers warn,

the figures revealed by federal regulators may not reflect their up-to-date

thinking.

The insurers’ decisions will be

closely dependent on moves by the Trump administration and Congress. Most

important is whether the federal government continues making payments that

reduce health-care costs for low-income exchange enrollees, which insurers say

are vital and President Donald Trump has threatened to halt.

Insurers are also concerned about

whether the Trump administration will enforce the requirement for most people

to have insurance coverage, which industry officials say helps hold down rates

by prodding young, healthy people to sign up for plans.

In Montana, Health Care Service

linked 17 percentage points of its 23% rate increase request to concerns about

the cost-sharing payments and enforcement of the mandate that requires everyone

to purchase insurance. Kurt Kossen, a senior vice president at Health Care

Service, said the company’s rate requests are driven by causes including

growing health costs and “uncertainty and the associated risks that exist

within this marketplace, including uncertainty around issues like the continued

funding of [cost-sharing payments] and mechanisms that encourage broad and

continuous coverage.”

Sen. Lamar Alexander (R., Tenn.),

who chairs the Senate committee that oversees health policy, said Tuesday that

he had told Mr. Trump directly that the government should continue making the

payments to insurance companies

The effect of the rate increases

will be blunted for many exchange enrollees, because lower-income people receive

federal subsidies that cover much of their premiums.

But increases could be tough to

stomach for those who aren’t eligible for the help, like Harland Stanley, 53,

of Louisville, Ky. Mr. Stanley, who owns his own research business, pays about

$400 a month for a plan from Anthem Inc., which is seeking an

average increase of 34% in the state, though Mr. Stanley’s own premiums might

rise by less or more than that.

“It’s going to hurt,” said Mr.

Stanley, who said his monthly premium this year is about $120 more than he paid

in 2016. “I worry about, what if it keeps going? When is this going to stop?”

Anthem, which is seeking rate

average increases of 30% or more in states including Colorado, Kentucky, Nevada

and Virginia, has said it would refile for bigger hikes and may pull back its

exchange offerings more if uncertainty continues around issues including the

cost-sharing payments.

Centene Corp.’s requests

ranged from less than 1% in New Hampshire to 21% in Texas and 12.49% in

Georgia. Those rate proposals generally assume the current rules surrounding

ACA plans continue, the company said.

Within the marketplaces, “there

is relative stability,” said Chief Executive Michael F. Neidorff. “The

uncertainty is driven by these policies on the ACA.”

CareSource, a nonprofit insurer

that offers exchange plans in four states, has prepared alternate rate filings

for different scenarios, and one of its state regulators Monday asked it to

refile with proposed rates that assume no cost-sharing payments.

“It’s challenging; you learn to

be very fluid,” said Steve Ringel, president of the Ohio market for CareSource.

According to actuarial firm Milliman Inc., at least seven states have made

similar requests in the past week, while others had earlier asked for two

versions of rate filings.

“Resolution of the [cost-sharing

payments] is an urgent issue,” said Bill Wehrle, a vice president at Kaiser

Permanente, which offers exchange plans in a number of states. “We’re coming up

at a point that’s fairly soon, where the pricing decisions we make are set for

all of next year.”

The impact of potentially losing

the cost-sharing payments was also clear in the rates requested by Blue Cross

of Idaho, which average 28%. That would probably be in the lower teens if the

payments were guaranteed, said Dave Jeppesen, a senior vice president. “It’s a

big swing,” he said. “There’s a lot of risk associated with the uncertainty in

Congress right now, and we are pricing appropriately for that risk.”

A recent Kaiser Family Foundation

analysis found insurers’ financial results on exchange plans improved in the

first quarter of this year, a sign of potentially emerging stability in the

business. That is reflected in a number of states where rate-increase requests

are limited. The exchange in California said Tuesday that insurers there were

seeking an overall average increase of 12.5%—but there would be an additional

12.4% boost layered onto middle-tier “silver” plans if the cost-sharing

subsidies aren’t paid.

However, in a number of cases,

insurers’ rate requests are well above 20% because of market factors not

directly tied to the federal uncertainty. Anthem has warned that it may need to

add 18% to 20% to its existing rate requests if the cost-sharing payments

aren’t locked in, and it may pull back in more states beyond the five exchanges

where it has disclosed plans to leave or sharply reduce its footprint. An

Anthem spokeswoman declined to comment on the company’s rate filings.

In Iowa, Medica said its rate

increase request was 43.5%, driven by the dynamics of the local market,

including the departure of other insurers and the fact that Medica itself has

been losing money because enrollees’ health costs ran higher than expected.

“You have some element of catching up to what the claims experience is,” says

Geoff Bartsh, a Medica vice president.

Medica’s requests in other states

have been far lower, he said, a sign of increased steadiness in those markets.

But, he said, if the cost-sharing payments go away, Medica estimates it will

need to add around 13% to 19% to its rate requests.

Click

here for the original article from Wall

Street Journal.