U.S. employers hired

at a healthy pace in July and the unemployment rate fell to match a

16-year-low, a show of lasting vitality for the labor market.

Nonfarm

payrolls rose by a seasonally

adjusted 209,000 in July from the prior month, the Labor

Department said Friday. The unemployment rate ticked down to 4.3% from 4.4% as

more people joined the workforce. The July unemployment rate matched May’s

reading as the lowest mark since 2001.

Economists surveyed

by The Wall Street Journal had expected 180,000 new jobs and a 4.3%

unemployment rate last month.

“This employment

report provides reassurance that the real economy remained solid at the start

of the third quarter,” said Michael Pearce, economist at Capital Economics. “If

the labor market continues to tighten over the coming months…the Fed will press

ahead with rate hikes.”

June’s payroll

increase was raised to 231,000 and May’s gain down to 145,000. Hiring has

accelerated this summer, though the pace for the year remains similar to 2016’s

monthly average.

When taken together

with record stock prices, steady economic growth, low inflation and high

consumer confidence, the economy appears to be in a bit of a sweet spot.

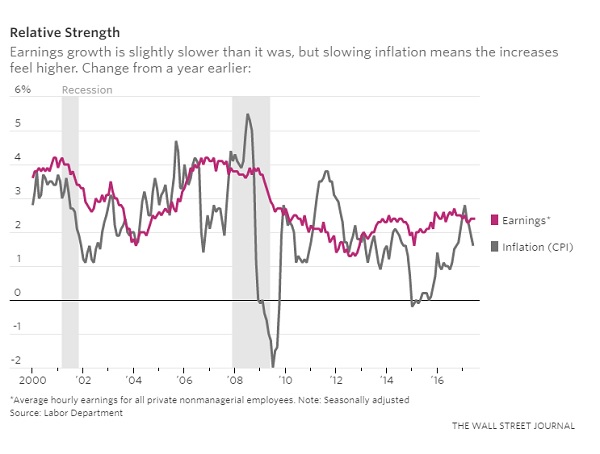

One missing

ingredient remains wage growth. From a year earlier, hourly earnings increased

2.5% for the fourth straight month. From a month earlier, there was a 9 cent

increase, the largest gain since October, but still relatively modest.

One factor in July

could be the mix of jobs added. One in four net new jobs last month came in

restaurants, among the lowest-paying fields, that could weigh on average gains.

Health care and manufacturing jobs also grew last month.

But the wage picture

isn’t all bad. When adjusting for inflation, wages are growing at stronger rate

than their 30-year average.

Several factors

likely held back better wage growth in recent years, including weak worker

productivity gains that challenge employers to justify raises. Many economists

expect wage growth to pick up, if hiring remains steady and the unemployment

rate falls.

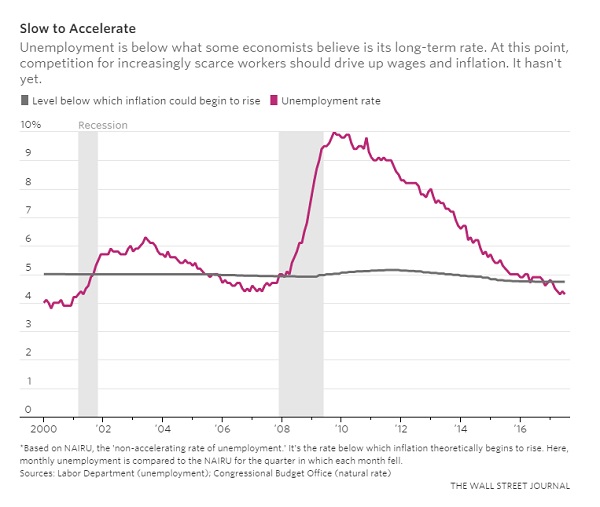

“I think we’re

getting to the point in many places…where they’re saying, ‘It’s going to cost

me too much money not to hire the extra labor. It’s worth paying those higher

wages’,” Eric Rosengren, president of the Federal Reserve Bank of Boston, said in an interview this week.

He said the

unemployment only recently fell below a level that should spark stronger wage

gains, which he expects are coming.

In response to broad

improvements across the labor market, the Federal Reserve has raised short-term

interest rates three times since December. Officials have penciled in one more

increase for this year and appear likely to gradually reduce the Fed’s $4.5

trillion asset portfolio, moves that could lead long-term rates to rise.

The U.S. labor

market has been a bright spot in a long recovery marked by slow growth. Economic

growth has been stuck near a 2% annual rate—the weakest expansion since World

War II. But hiring has been consistent, with payrolls expanding for 82 straight

months.

The period of

monthly gains that began in 2010 is almost 3 years longer than the second-best

streak from 1986 to 1990.

There are still some

underlying signs of softness in the labor market.

The labor-force

participation rate edged up to 62.9% in July from 62.8% the prior month, but

remains near the lowest share of adults working or seeking work since the

1970s.

Labor-force

participation has been trending lower for nearly two decades, partly because

the population is aging and more workers are retiring. It has mostly stabilized

in the past year, suggesting some Americans who had given up searching are

being drawn back to the workforce. If that is happening, the labor market might

not be as tight as the unemployment rate suggests.

An alternative

measure of unemployment and underemployment, which includes those who have

stopped looking and those in part-time jobs who want full-time positions, was

8.6% in July, unchanged from the prior month. The rate, known as the U-6, fell

as low as 7.9% in the prior economic expansion that ended in late 2007.

Click here for the original

article from Wall Street Journal.